With the first weekly Open in 2022, here is a detailed Crypto Market update based on Macro-Outlook.

As we have closed one of the most wild years in Crypto markets history, with all its ups and downs, starting with Bitcoin Rally to 64K followed by the impressive Altseason, through May Market crash followed by another rally to 69K and the latest correction towards 45K zone, 2021 was really one of the most crazy years in Crypto markets.

Let’s start to break down the macro to micro market structure and try to read and analyse all the presented data and possible scenarios with 0 bias “as usual”

Let’s get directly into the details, briefly & straight forward.

Bitcoin

BTC didn’t repeat any of its known PA or behaviour during this cycle, some key technical indicators like Weekly EMA21 which was the main handler of previous bull runs, totally failed during this cycle, also Weekly MA50 which usually was able to provide a “relatively” small bounce followed immediately by bear market, acted differently this cycle and provided a massive bounce from 30K to 69K ( a bounce from MA50 led to a new ATH which never happen before for BTC)

According to above mentioned data, I prefer not to rely much on previous cycles behaviour.

Chart Link: TV Chart, Compare Last & Current Bull Cycle

So Now We agree that Previous cycles data don’t fit current cycle, for many reasons

1-Leverage & Futures on Alts (We didn’t have such products before)

2-USD(s) Pairs on everything (we had BTC pairs only last cycle)

3-Relatively much bigger Market Cap

4-New Players such as institutions and Wall-Street giants whom joined our tiny Crypto space

What is Happening on Quarterly and Weekly Level Charts?

Quarterly: Still inside bars, Fake-outs didn’t change anything

Weekly: Still Struggling to hold MA50, more details about EMA21/50/200 and their importance is on the chart:

Chart-1: BTC Quarterly and weekly:

https://www.tradingview.com/x/LQpC7toc/

On Weekly Prospective, if I saw MA50 is lost, that will mean two things:

1- We are NOT in trendy market anymore

2- All focus will be on Horizontal levels, on HTFs we have 30K zone, 40-41K zone with mid-ranges in between (45 and 35.5)

So What Kind of Cycle Shall we Consider Now? Are we in a Bull Market or Bear Market?

Based on All Data presented and new players behaviour, I believe that we are in Horizontal market structure which can be a part of bigger/longer cycle, here are the Two Scenarios:

1- Scenario-A , Extended Cycle:

just like the legacy markets, where bullish cycle is usually extended for Several years, till it gets into the bubble-mode , Accordingly, short length EMAs/MAs are not the ones to follow like we did in 2016-2017.

This suggests another 1~3 years of New type of Bull Market where we have plenty of tough corrections and pullbacks to wipe out the crowded leveraged longs especially on Altcoins

Slow-Steady growth similar to legacy markets, which ends of last parabolic move, blow-off top then multi year Bear Market.

How Am I going to Play This Scenario?

DCA Bitcoin, Filling Spot gradually, all the way (up & down), even if this theory was invalidated, I will keep DCAing BTC all the way down to Weekly MA200 (bear market) to prepare myself for the next bull market.

in parallel, Swing & Day Trading Alts/USD, Spot & Futures, fully focused on hot coins/sectors which are keep changing (IEOs, DeFi, NFT, Metaverse, L1,L2,…)

Note: I trade Bitcoin & Altcoins Mainly on: Phemex (Cheapest, fastest, most secure) + FTX (Stable/full of good products like indexes and tokenized Stocks) , and of course, Binance (the most liquid Crypto market)

Sticking to strict risk management while trading Altcoins in such conditions due to the repetitive 30~60% nukes we are witnessing on Alts due to the over-leveraged futures market.

Click here to register on Phemex with Fees Discount + Deposit Bonus (I highly recommend you to give it a try)

( I save ALOT on Phemex by paying 10$ fixed monthly to get 0 Spot Fees + Negative Futures Maker fees)

Click here to register on FTX with Fees Discount (Highly recommended)

Click here to register on Binance with Fees Discount

2- Scenario-B , Bear OR Horizontal Market:

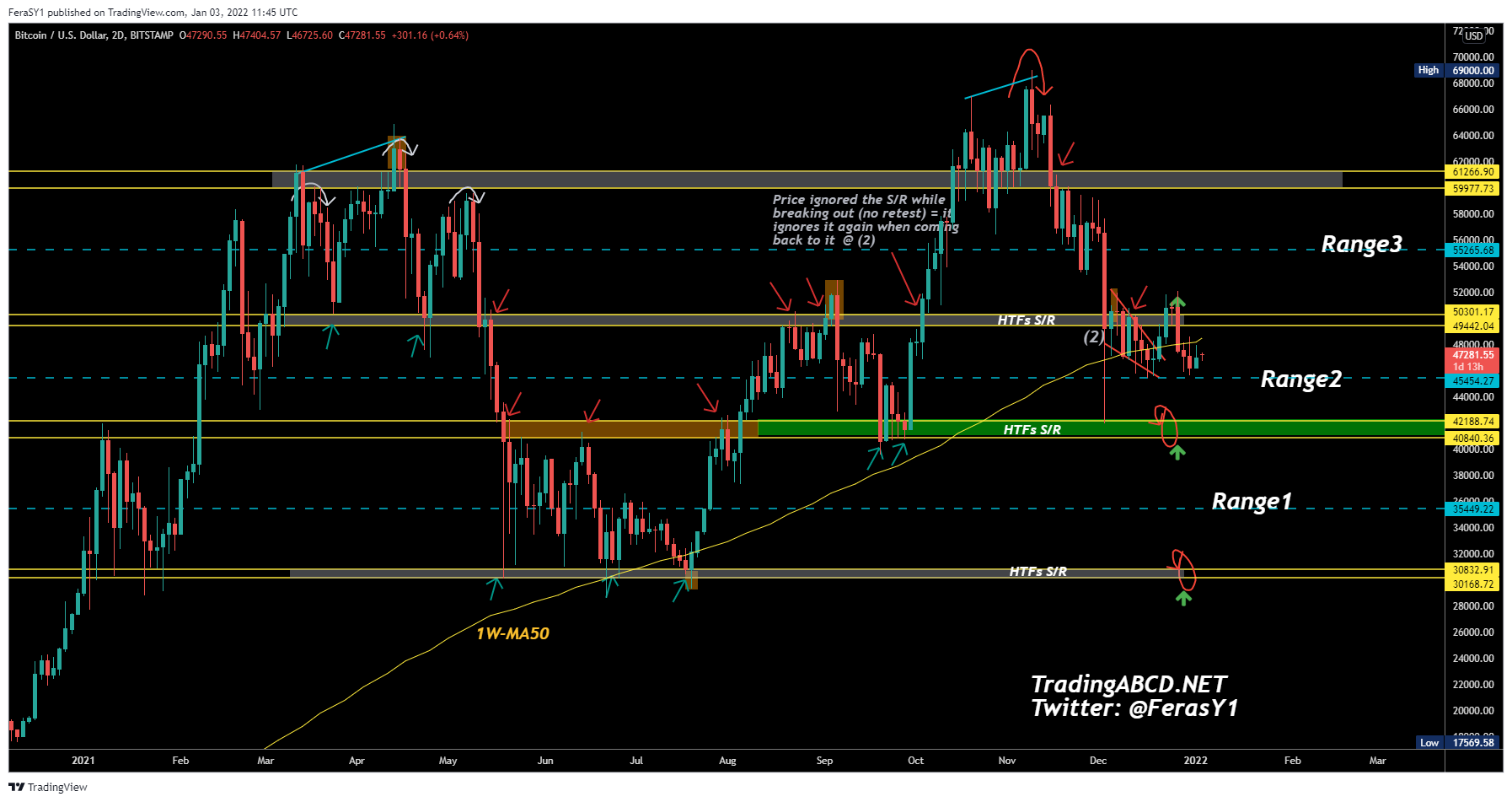

if we start losing MA50 which BTC is already struggling to maintain, the focus will flip towards horizontal levels, HTFs weekly Levels @ 30-31K. 40-41K 5-51K and 58~60K are the current Key horizontal levels

Playing it level to level, trade to trade, with strict risk management on Alts, in parallel, DCAing BTC at each Mid & HTFs key level

here is an example of my DCA Strategy for current #Bitcoin Range: https://twitter.com/FeraSY1/status/1472707431125983237

DCA: Dollar Cost Average

Horizontal Market Structure with Key H-Levels:

https://www.tradingview.com/x/Qo6LVsoY/

in Brief:

We are still trading inside 2021Q1 candle, insider-bars with no HTFs break out

on lower TFs (Daily,weekly) BTC is stepping up/down, level to level based on horizontal levels

Still, MA50 on Weekly is important dynamic support to be watched, however, if lost it, the same horizontal levels will be in play

.

Altcoins Macro Outlook

If you have been in this market for few years, you will definitely realise that Alts are moving in cycles, Money flow between Bitcoin, Altcoins and Stable coins on cycle based

The Best indicator to read the Altcoins cycles is BTC.D (Bitcoin Dominance)

The Logic is simple, When Dominance is at high velue (60-70%) and it’s dropping, then that means the Money is flowing towards Altcoins, which we call it Altseason (rapid break-down of BTC.D from 70 to 30% zone).

And when The Dominance is Trending up from 30-40% Zone towards 60s-70s then it’s Bitcoin Cycle, and Alts are under-performing Bitcoin in such parts of the cycle

here is a breakdown of last few years BTC.D cycles:

The Simple Logic is:

Buy/Trade/Hold Alts when BTC.D is getting rejected of its resistance & when it’s Downtrending, and vise-versa, Focus on BTC and hold BTC+USDs when the Dominance is at Support and uptrending

On a macro prospective,

We are near the end of the offloading zone of #Altcoins, here were exchanges/Projects/MMs are almost done dumping all the accumulated bags, there are always few exceptions here and there, but the big picture suggests me not to “invest” alot in Alts.

Minimizing alts investments, focus on very few ones with very limited size, in parallel Keep DCAing into bitcoin

So. The plan for Altcoins is:

1-Follow the Big-Smart money which have been cashing out of Altcoins holdings

2-Focus on Few Strong/Trendy Alts, luckily even in bear market, there are always exceptions and there are always that black-horse which keep trending against the entire market direction, last few weeks Alts like LUNA, MATIC and NEAR were the black horses, this keep changing. try to detect the trend and ride it as early as possible

3-Be sharp, with no tolerance, Trade Altcoins With Strict Risk Management, push more when BTC.D is at local resistance, step back on BTC.D is showing strength or when it’s at local support

4-instead of investing randomly of big bunch of alts including old/dead projects, you may seek for new opportunities (Gems), usually the best strategy is to get into these gems before they got listed on major exchanges (Binance & Coinbase) which usually provide the exit liquidity for early investors

you better avoid having a big mix of Alts/big caps, cuz usually they under-perform BTC especially when the dominance starts shooting up (with btc strength or with btc nukes)

The Alts to be invested are usually seasonal ones, new tokens, fresh blood, based on weekly or 3D charts

We have seen recently that these gems are mostly found on these two exchanges:

1- Kucoin, here is a registration link, please use if you don’t have Kucoin account yet:

KuCoin Registration Link

2-MEXC, if you don’t have an account, make sure to get one, here is my ref link, thanks for using it:

MEXC Registration Page

You Better not to go big in new coins (Gems) cuz as we all know, many fails, but catching one or two X50-X100 is enough to literally change your life, so never ignore this part, even when Market is not in its best form

One Last Advice for Trading Alts:

You need to know your style, and then to focus on specific type of Setups, the ones which works for you, either it’s investment, swing trading, scalping and day-trading, …

-if u aim to get the Best Win Rate, Buy Dips on Trending #Altcoins

example of 2021 recent trendy ones ($NEAR $DUSK $LUNA $ATOM,..)

-Want Trades w/ Maximum R:R (however less potential win-rate)?

Pick Some $Alts sitting on HTFs S/R / Range-Low

-Prefer Safety? Stay in $BTC+ $USD till we get clarity & Trendy Market

if you would like to get more of this content, Stay tuned, Turn the notifications on and make sure to follow me:

Twitter

YouTube (big things are coming here)

if you would like to learn Trading & Technical Analysis & Trade with me, Feel free to join my community through TradingABCD.Net