#Bitcoin investing Simplified📢

Far from CT gurus, Real investors never try to time the market/buy bottoms or sell tops

instead, they average-in after a heavy downtrend, then average-out during/after a parabolic move up

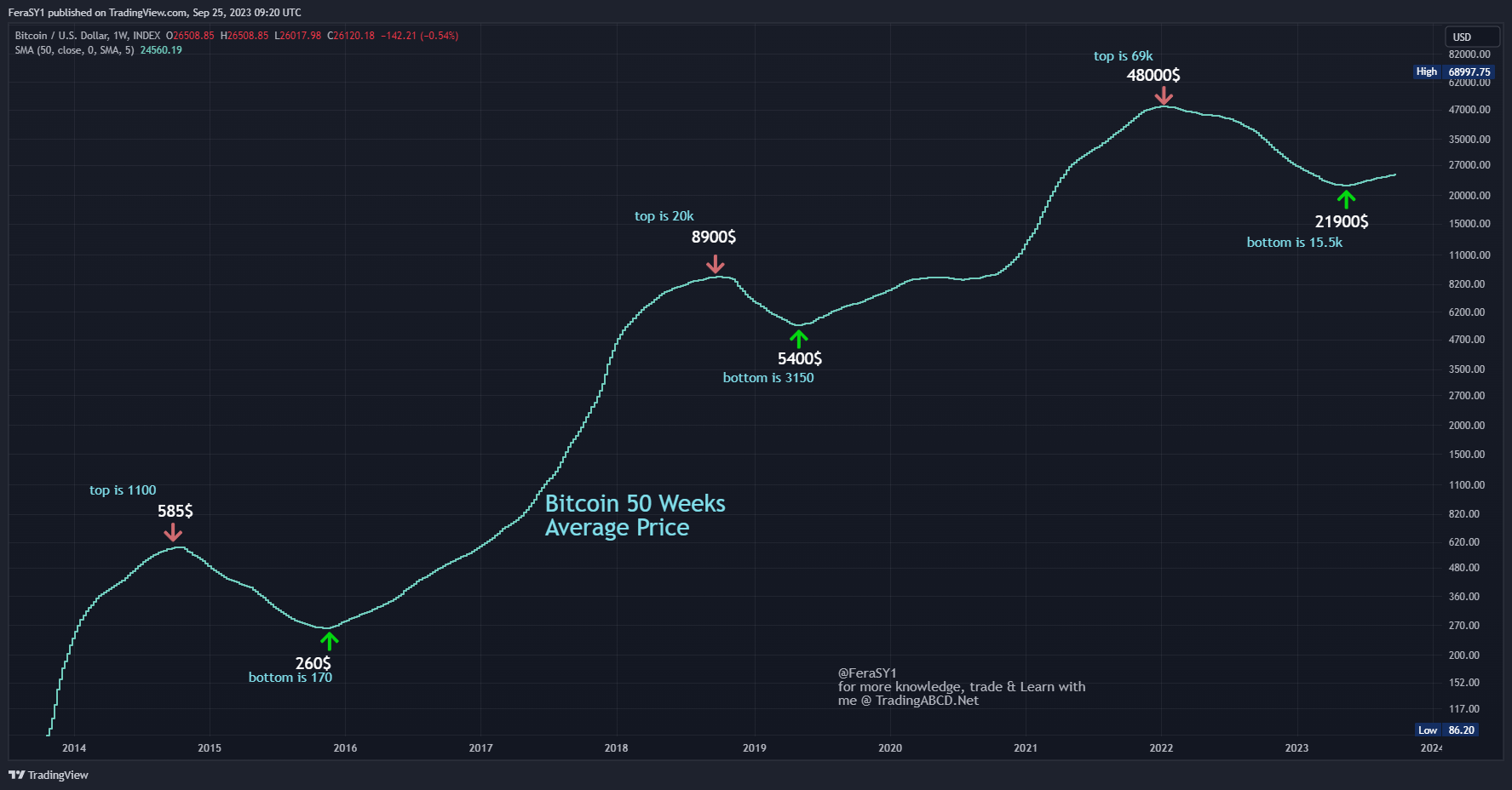

This is #Bitcoin 50weeks average price

-notice how MA50 already changed its direction, with lowest average of 21.9k

-by averaging around that price, you usually get the best realistic average entry during bear market

(far from fake absolute bottom buyers)

but how to make sure you can average-in and average-out properly? here is a serious ALPHA that you can learn and apply:

When/When to Buy?

personally I prefer to start averaging once BTC is already down 60%+ of its ATH, despite the negativity and bad new, I keep adding gradually on red days

then the serious ADD to your position must be after EMA5 Crosses above EMA21 on 1W TF, this won’t be the absolute bottom but it will indicates an early serious sign of trend direction change

if you missed that, don’t worry, usually, $BTC gives another single chance to buy around MA50 few months after the bottom formation (it usually dips toward MA50 area where u can really get a serious portion of #BTC)

again, remember, you need to average near that area, you don’t have to pick the micro bottom

What if BTC dipped below my entry?

that is usually nothing but a great news for long term investors, they simply do nothing, or they add more to their position taking their average entry lower which amplify their next cycle returns

When/When to sell?

you need to plan when to sell, here also you need a simplified system, here is a free alpha about it:

1- Sell the first small portions during a serious parabolic run and a series of massive green candles on 3D TF

2- Start the heavy selling ONLY when MA5 starts crossing below MA21 on 1W TF, that usually indicates the first serious warning of trend direction change

What other important advices?

1- Custody: your security must be always #1 priority, never put all your bitcoins in a single place/wallet/exchange, also keep in mind that even self custody has its own risks

for CEX usage, I do recommend you to use secure exchanges, my #1 choice is Phemex, followed by Binance and bitget, I will attach my ref links below, by using them you will be supporting me for free, I do appreciate that.

2- ignore news/Stick to your plan:

during the bear market, you gonna get ton of massive bad news, they will let you think that #btcusd will never recover again, just ignore that and stick to your buying plan.

Same during bull market, u will get ton of good and massive news around the top, also you need to ignore and stick to your selling plan.

Trusted exchanges to buy bitcoin from:

#1- Phemex

by far, the best and most secure exchange with lowest fees.

Spot and derivatives, top level security & stability, it’s always my first choice to buy/hold/trade bitcoin:

https://phemex.com/register?group=54&referralCode=F8G8K

https://phemex.com/register?group=54&referralCode=F8G8K

#2- Binance, well known, the biggest in the industry

#3- Bitget,

another high quality secure/stable exchange that I use for both futures & spot:

if you want to learn more and trade with me, you may need to join my Trading community where I share ton of market updates/insights/ my investing plan/ my trades/ my entries and exits, and indeed my technical analysis knowledge:

25-09-2023

investing in #Bitcoin 101